Real Estate Tokenization in 2026: Your Simple Guide to Owning Digital Property

Ever wanted to throw your money into a piece of prime real estate without having to buy the whole building? Think about this: What if you could own a little chunk of a luxury villa in Dubai, an office building in Tokyo or some new condos going up in Canada? And what if you could use any device to manage all that?

This isn’t some “Thousands of years of history and particularly the past 14 have made us very risk averse” future concept, it’s happening in real time with real estate tokenization, and 2026 is when proof of concepts become mainstream financial instruments.

This explainer demystifies that exciting new technology. We’ll break it down in plain language, look into why the next year is a turning point and explain how this could be good for everyone from first-time investors to huge institutions.

What Is Real Estate Tokenization? A Simple Analogy

Tokenization is kind of like digitizing an old-fashioned certificate of ownership for a property. Instead of a paper deed to the whole building, blockchain allows you to make thousands of digital “tokens,” one for each percentage point. Each token serves as a secure digital share proving that you have ownership to some small portion of that property.

Traditional Real Estate: Purchasing a property is overwhelming, paperwork-laden transaction that includes agents, lawyers and banks. It is capital intensive and could take months to sell. It’s an illiquid asset not easily turned into cash with a few taps on the smartphone.

Tokenized Real Estate A property’s value is divided into digital tokens on the blockchain (a secure, transparent digital ledger). You can purchase one, 10 or 100 tokens, which are then affordable as an investment. These tokens are often tradable on digital marketplaces, bringing liquidity to a previously illiquid asset class.

Why Is 2026 the Pivotal Year for Tokenization?

For years, the focus was on the “how” — proving that the technology worked. In 2026, it seems pretty clear that the emphasis is now on constructing liquid, productive markets. Several key drivers are converging:

Regulatory Clarity: The world’s largest economies are imposing rules. The EU’sMiCA regulation offers a framework for crypto-assets, government-sponsored pilots are being rolled out in places like Dubai and Singapore and the U.S. is beginning to see regulatory guidance emerge for tokenized securities. Big institutions get comfort from this clarity.

Institutional Adoption: Not just for tech startups anymore. The big trading companies such as BlackRock and JPMorgan, along with the New York Stock Exchange (NYSE), are now working on building tokenized products and systems.

Market Proof & Scale: Projects are past the test phase. In 2025, for example, Japan had a three billion dollars tokenization plan in the middle east went public. Deloitte estimates this total value of tokenized real estate could surge from $300 billion in 2024 to $4 trillion by 2035.

Who Benefits from Tokenization? A Win-Win-Win Scenario

For Investors (Big and Small)

Reduced Entry Barriers: Get into investing without hundreds of thousands only $100-$1,000.

Global Portfolio Diversification: You can own pieces of properties all over the world, of varying types (houses, shops, warehouses), as simply as you might have shares with traditional investing.

More Liquidity: Trade tokens on the secondary markets if you desire which may enable access to your funds quicker than selling an entire property.

For Property Owners & Developers

Accelerated Capital Raising: Tap into global investor pools to finance projects, or sell assets with greater ease.

Cut out Middlemen & Save: Use “smart contracts” that automatically enforce the transfer of ownership, revenue distribution as well as hold parties accountable to each other all for a fraction of the cost and time it takes lawyers or agents.

New Ways to Earn: Claim small rewards automatically every time tokens are exchanged in your property on the secondary market.

Clear Land Registries: Dubai is developing their own trials of blockchain based land registries in its land department to prevent fraud and simplify transactions.

Transparent and Automated Portfolio Management: Firms can transparently manage their portfolios and automate complicated processes.

Markets On Steroids: Governments can take steps to encourage international investment and make financial systems more modern.

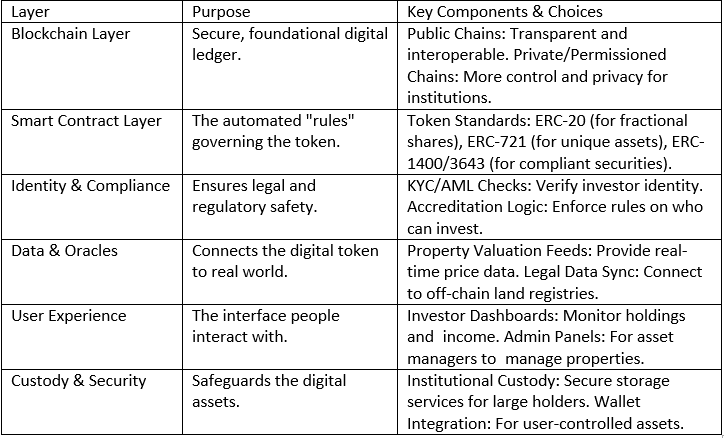

The Technology Stack: What If I Wanted to Dig In?

Creating a tokenized real estate platform is akin to constructing a safe, stable digital building.

Applications Now Emerging in the Real World in 2026

Tokenization can be found throughout the real estate market:

Luxury & Realty: From tokenized UAE villas through to fractional ownership in US single family housing starting from $100.

Commercial Real Estate (CRE): It is a huge growth market. Tokenizing shares of office buildings, shopping centers and logistics warehouses democratizes” those investments.

Real Estate Funds & Debt: Reputation-centric real estate funds and mortgage-backed securities are being tokenized for efficiency, transparency, and liquidity.

Development Projects – Tokenization of Raw land, or Under Construction Projects by developers to raise capital through a new means from global investors.

Key Trends and the Road Ahead

As we think about 2026 and beyond, some key trends will shape the future:

AI-Powered Platforms: AI will rock the industry by handling real-time pricing, risk analysis and predictive analytics and providing investors with a whole set of new cool features.

Interoperability & Mobility: The vision is that tokenized assets would flow freely between various blockchain environments, crossing jurisdictions as well as entering a single global market.

DeFi integration: For already vastly illiquid real estate, tokenized leverage and borrowing in DeFi lending and borrowing protocols could integrate real estate as a potentially more liquid form of collateral to borrow against without having to sell.

Normalization: Tokenization is breaking out from the “crypto” toy box and being considered as a standard, institutional-grade financial innovation tool.

Final Thoughts

Real estate tokenization by 2026: The players to know This is a transformative move from an exclusive, inefficient and opaque real estate industry. It’s making one of the largest asset classes in the world more accessible to Democrats and Republicans alike — and giving an ancient market a digital facelift.

For investors, it is a new world of opportunity. For the industry, it’s a wake-up call to embrace change and innovation. The groundwork is now in place, the rules are becoming clearer and the market is ready for scale. In 2026 the question is not whether we will reach such mass-adoption of tokenization, but how soon you will start exploring its potential.

FAQs

What is real estate tokenization in simple terms?

It’s a means of changing ownership over a physical property into digital tokens on a blockchain. Each token is a stake in the asset, similar to digital stock in a building.

Is real estate tokenization legal?

The legal landscape is evolving rapidly. In 2026, jurisdictions like the EU (under MiCA), Singapore, Dubai, and Switzerland have established regulatory frameworks that make compliant tokenization legal. Always verify the rules specific to your location and the asset.

How do investors earn from tokenized real estate?

The investment is a double reward one: through the potential appreciation of the token value (if and when the property value appreciates) and distributed rental income that can be automatically paid to token holders using smart contracts.

Which blockchain is best for real estate tokenization?

There's no single "best" choice. Ethereum is so much more widely adopted, because of its security and sound standards. Institutions also favor permissioned or hybrid blockchains, which they use for more privacy. Which is best really depends on the project's regulation, scalability and cost requirements.

Is real estate tokenization safe in 2026?

Safety has greatly improved with regulated platforms, institutional custody solutions, and audited smart contracts. However, risks remain, including regulatory changes, technology vulnerabilities, and market liquidity. Always use licensed platforms and conduct deep due diligence